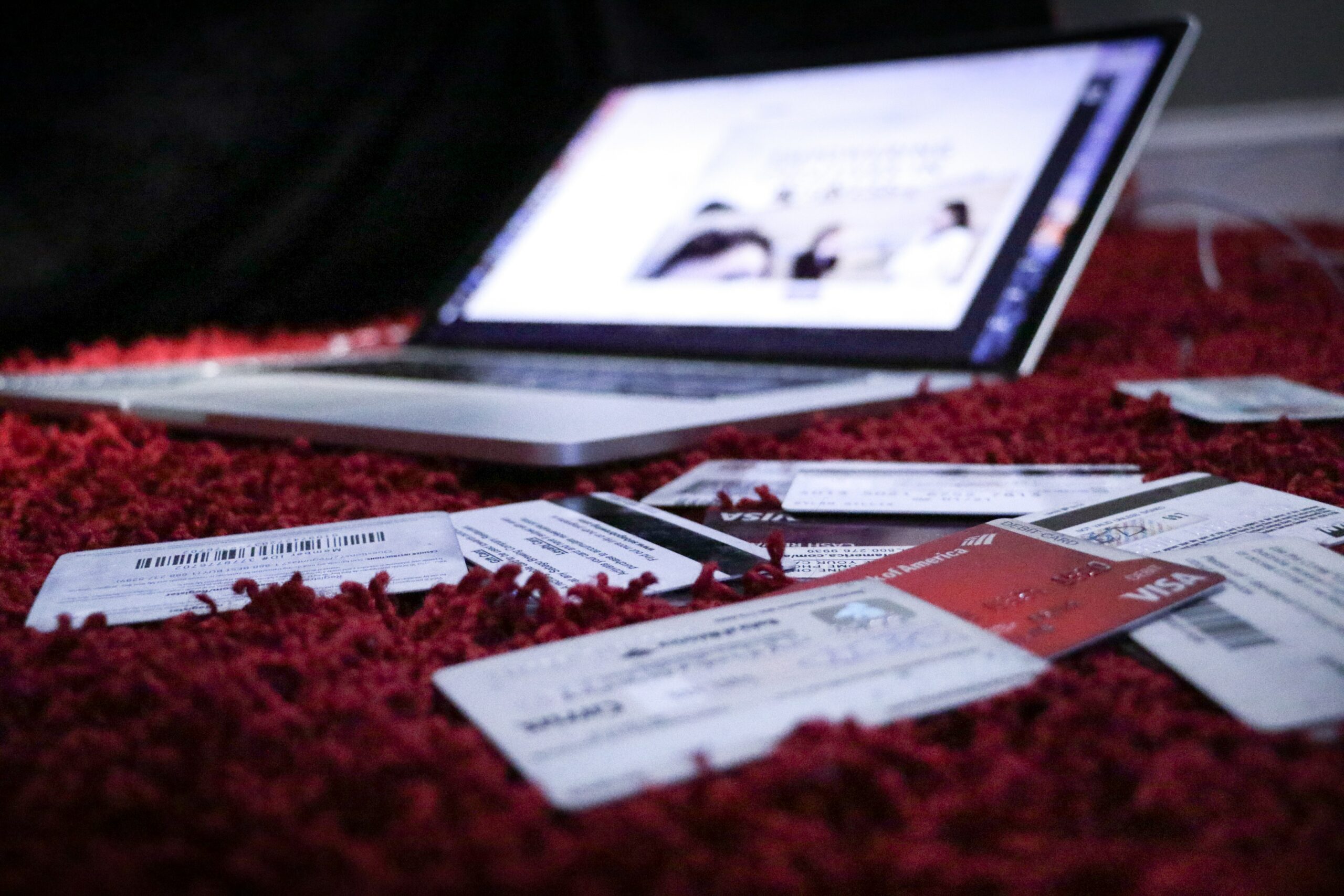

D & R Incorporated is an accredited Administrator so let’s list the Pro’s and Con’s to an Administration Order debt solution:

Pro’s to Administration

• You receive the legal protection of a debt restructuring court order that protects your salary and assets • Pay one affordable monthly installment for all of your unsecured debt • All garnishee orders will be removed from your salary deductions (except child support) • A custom budget is created for you to ensure sufficient provision has been made for your basic living expenses that enables you to live comfortably whilst you pay off your debt • No more harassment from your creditors, by law your creditors must stop all communication with you • Immediate relief from your bad debts • No upfront fees are required • A 74U Clearance Certificate will be issued once all your administration debt is settled and the fact that you are under admin will no longer be reflected on your credit record • If you default on your payment plan your creditors cannot simply terminate the admin order immediately providing you with legal protection that is second to noneCon’s to Administration

• Your total debt cannot exceed R50 000 • House bonds and Car Finance cannot be included • Self Employed individuals do not qualify for Administration • Once under admin, you may not obtain any further credit until your current debt has been paid in full • Legal fees are charged in accordance with the law to enable the Administrator to represent you in court, to process your application, to communicate, negotiate and update your creditors constantly, to execute the legally required proof of delivery, to arrange a sheriff to act on your file, to make quarterly distributions to your creditors and maintain your file to name a few. These fees are worked into your repayment plan • Being under Admin will reflect on your credit record until your Administration is settled. Once your admin debt is settled a 74U certificate will be issued and the fact that you are under admin will no longer be reflected on your credit record